SentinelOne in the Financial Sector: Securing Data and Transactions

The financial sector is a prime target for cybercriminals due to the valuable nature of the data and transactions it handles. With the rapid advancement of digital technologies, financial institutions have increasingly become reliant on cloud-based systems and digital platforms to manage operations and provide services to their customers. However, this shift has also exposed them to a range of cybersecurity threats, including malware, ransomware, phishing, and data breaches. As a result, securing sensitive financial data and transactions has become more critical than ever.

One of the leading cybersecurity solutions that has garnered attention in recent years is SentinelOne, an advanced endpoint protection platform that leverages artificial intelligence (AI) and machine learning (ML) to secure networks against a wide range of cyber threats. SentinelOne is particularly well-suited to protect the financial sector due to its innovative approach to detecting, preventing, and responding to security incidents in real time.

What is SentinelOne?

SentinelOne is an AI-driven cybersecurity platform that offers autonomous endpoint protection for organizations, providing real-time detection and response to cyber threats. Unlike traditional antivirus solutions that rely on signature-based methods to detect known threats, SentinelOne utilizes machine learning algorithms to analyse endpoint behaviours and identify potential threats before they cause harm. The platform is capable of providing protection against a wide range of attacks, including zero-day threats, advanced persistent threats (APTs), and fileless malware.

One of the key features of SentinelOne is its ability to operate autonomously, meaning it can identify and respond to threats without the need for constant human intervention. This proactive approach to cybersecurity ensures that financial institutions are not only protected from current threats but also prepared for new and emerging attack techniques.

Why is SentinelOne Important in the Financial Sector?

The financial sector faces a number of unique cybersecurity challenges. From protecting sensitive customer data and financial transactions to ensuring the integrity of financial systems, financial institutions are constantly at risk of being targeted by cybercriminals. SentinelOne’s advanced threat detection and response capabilities make it an invaluable tool for securing the financial sector against these threats.

1. Protecting Sensitive Data

In the financial industry, data is the most valuable asset. Institutions handle vast amounts of personally identifiable information (PII), banking details, and transaction data on a daily basis. If a cybercriminal gains access to this sensitive data, it can result in significant financial losses, reputational damage, and legal ramifications.

SentinelOne provides robust data protection through its AI-driven endpoint protection, which can identify malicious activity and isolate compromised systems in real-time. This helps prevent unauthorized access to sensitive information and ensures that customer data remains secure.

2. Securing Financial Transactions

Financial transactions are a prime target for cybercriminals, as they can lead to significant monetary theft. Cybercriminals often use techniques such as man-in-the-middle (MITM) attacks, phishing, and ransomware to intercept, manipulate, or steal funds during transactions. This can lead to serious financial losses for both the institution and its customers.

SentinelOne can help prevent these types of attacks by continuously monitoring transaction processes and detecting any suspicious activity. Its autonomous response feature can immediately block malicious transactions and alert security teams to take action, minimizing the risk of financial loss.

3. Preventing Ransomware Attacks

Ransomware attacks are particularly dangerous for the financial sector. Cybercriminals use ransomware to encrypt critical files and demand a ransom payment for the decryption key. For financial institutions, a successful ransomware attack could halt operations, cause a data breach, and result in severe financial and reputational damage.

SentinelOne is designed to prevent ransomware attacks by detecting malicious file modifications, abnormal behaviour, and encryption activities. Its machine learning algorithms can stop ransomware before it encrypts data, providing financial institutions with a reliable defence against this growing threat.

4. Enhancing Regulatory Compliance

The financial sector is heavily regulated, with organizations needing to comply with various laws and standards such as the General Data Protection Regulation (GDPR), Payment Card Industry Data Security Standard (PCI DSS), and Sarbanes-Oxley Act (SOX). These regulations require financial institutions to implement strict cybersecurity measures to protect customer data and financial transactions.

SentinelOne helps financial institutions meet regulatory compliance requirements by providing comprehensive security monitoring, reporting, and auditing capabilities. With real-time threat detection and incident response, SentinelOne ensures that financial organizations can demonstrate their commitment to cybersecurity and comply with industry standards.

5. Reducing the Impact of Data Breaches

Despite the best efforts of financial institutions, data breaches are still a reality. When a breach occurs, it can result in significant financial losses, legal consequences, and a damaged reputation. SentinelOne can help mitigate the impact of data breaches by quickly identifying compromised systems and stopping the spread of malicious activity.

In the event of a breach, SentinelOne’s endpoint protection platform can automatically isolate affected devices and prevent further damage. This quick response minimizes the overall impact of the breach and reduces the likelihood of a widespread security incident.

Read more: How to Integrate SentinelOne with Your Security System

How SentinelOne Enhances Cybersecurity in the Financial Sector

SentinelOne offers several features that make it an ideal solution for the financial sector:

- Autonomous Threat Detection and Response: SentinelOne’s AI-powered platform can automatically detect and respond to threats, reducing the need for manual intervention and ensuring real-time protection.

- Behavioural Analysis: Instead of relying on traditional signature-based methods, SentinelOne uses behavioural analysis to identify and block both known and unknown threats, providing proactive protection against emerging attack techniques.

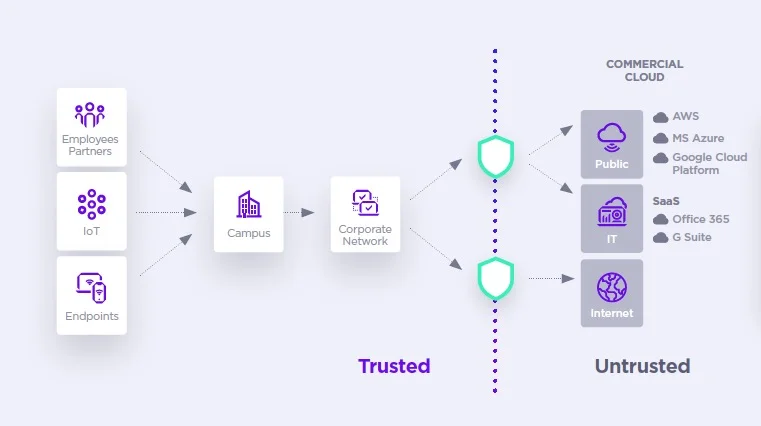

- Cloud-Native Architecture: SentinelOne operates on a cloud-native architecture, allowing financial institutions to deploy and manage security solutions across distributed environments with ease.

- Centralized Management Console: SentinelOne provides a centralized management console that allows security teams to monitor, manage, and respond to incidents across all endpoints in real-time, ensuring that the financial institution’s entire network is secured.

- Comprehensive Reporting and Analytics: SentinelOne provides detailed reporting and analytics that help financial organizations identify security weaknesses, track compliance, and assess the effectiveness of their cybersecurity strategies.

Conclusion

As cyber threats continue to evolve, the financial sector must remain vigilant in protecting its data and transactions. SentinelOne offers an advanced, AI-driven cybersecurity solution that helps financial institutions secure sensitive customer data, prevent cyberattacks, and comply with industry regulations. With its autonomous threat detection, behavioural analysis, and real-time response capabilities, SentinelOne provides financial organizations with the tools they need to stay one step ahead of cybercriminals and ensure the safety of their systems and data.

By leveraging SentinelOne’s cutting-edge technology, the financial sector can strengthen its security posture, minimize risks, and safeguard the trust of its customers. Contact Us for detail information.